Reliable, honest, and Florida-based — Top Notch Roofing offers free inspections to keep your home protected.

Hopefully you never have to file a claim for roof damage or replacement based on a catastrophic event. However, if it happens, Top Notch Roofing is here to help! We are a trusted, local, insured, licensed Florida roofing contractor with more than 15 years of experience. We provide residential roofing services and commercial roofing services all over the state. See our guide to disaster recovery in Florida below.

After a catastrophic event, we recommend that you have your roof inspected prior to contacting your insurance company. You should only file a claim after an inspection has occurred and your roofing contractor has verified damage. This may save you from filing a possibly unnecessary claim.

Elevated Roofing is happy to provide you with a free roof assessment. We provide a detailed photo inspection report of any damages or issues we find. Call us at (321) 299-3591 or contact us online to schedule an evaluation.

If your roofing contractor has verified damage to your roof and property, call the catastrophe claims number in your insurance policy to report your claim to your insurance company. Get your claim number.

The insurance company will assign an adjuster to your claim, who will contact you within a few days. The adjuster will set an appointment to inspect your property damage in order to set an amount for the claim.

We recommend that you have a trusted, roofing contractor to be your advocate during the adjuster’s inspection. Top Notch Roofing works with major insurance companies every day. Insurance adjusters are very busy after catastrophic events, and may overlook an important aspect of your claim. We will ensure your adjuster understands the extent of the damage and that the roof measurements are accurate.

We will ask you to sign an authorization form allowing us to speak with your insurance company about your claim. This will speed up the process and cut back on phone calls in which you relay every message back and forth.

This form can be faxed to your insurance company when filing the claim or later in the insurance claims process. You will still be involved in the decision-making process of course, but will not have to address every little detail.

Within several weeks, you will receive the Adjuster’s Claim Summary. This summary from your insurance adjuster lists all the items on your home to be replaced and/or repaired.

Insurance policies are generally written two different ways. They will either be actual cash value (ACV) plans or replacement cost value (RCV) plans.

If you have Actual Cash Value (ACV) coverage, you will receive one check around the same time of your adjuster’s claim summary. This check will be the adjuster’s figure for replacing the roof based on his or her calculations, minus the depreciation for the age of the roof and any other covered items. A percentage of the replacement cost is withheld based on the amount of years left on the life of the shingles and on any other items, minus the amount of your deductible.

Under Florida Insurance Code, you will personally have to fund the amount of your deductible. There is no legal or ethical way around that. Top Notch Roofing requires the insured to pay their deductible – that is the law.

For example, let’s say you have an actual cash value plan. Your $100,000 home has a 20-year warranty on shingles that are 10 years old, with a one percent deductible. If the price of your new roof is $5,000, your insurance company will pay half of the replacement cost and withhold the amount of your deductible ($2,500 minus $1,000). The check you receive would be $1,500. You would be responsible for paying the other $3,500 out of pocket.

If you have Replacement Cost Value (RCV) coverage, you may receive your funding in two separate payments. You would still receive the same actual cash value check with the adjuster’s claim summary. However, you can request a second check from your insurance company for your replacement cost, or recoverable depreciation upon completion of the roof claim.

To keep our same scenario, if you had no other changes to the claim summary, this reimbursement check would be for $2,500, for the amount they withheld for the depreciation of the aging roof. You are still responsible for your deductible. We explain the process for requesting this check further down the page.

When you receive your adjuster’s claim summary, send a copy to your project manager or our office. We will review the data to ensure you reach an adequate settlement. There may be details the adjuster has overlooked, depending on his or her level of experience. Adjusters are busy after a storm, and many have little to no knowledge of roofing. We will note any missing items. The insurance company will most likely fund these through supplements.

If the adjuster’s summary does not adequately cover the expenses of a quality roof replacement, we will work with you and your insurance to get what you deserve. This back and forth process may take four to six weeks, depending on availability of your adjuster.

It is important to be patient during this process. Your insurance company has certain steps or layers of resistance it goes through as a rule. By the end of the process, we are usually very successful in obtaining supplements to cover everything needed for a high quality roof. Many claims do need supplementing to provide a quality roof job, which is what you want as a homeowner.

It takes time for the mortgage company to endorse the check and return it to you, so do not hold on to this check. Send it off immediately to the lien holder for endorsement.

Many banks hold insurance checks for up to 10 days before releasing funds. After you receive your check, it may take up to four weeks to actually have the funds available in your account. This is why we encourage you to not hold on to the checks, but to send them off immediately for endorsement.

We get paid by you personally, not the insurance company. The funds will need to be available in your account upon completion of the job.

Once an adequate price is determined (or immediately if the first check funds the project from the beginning) and you have received and processed your first check from the insurance company, we will schedule your roof repair and/or roof replacement. Once the project begins, it typically only takes a couple of days to provide you with a beautiful new roof that will last for years to come.

At the completion of the job, we will collect a personal check from you for the full amount of the roof replacement, which is the amount decided upon by the insurance company. You will most likely have received any supplement checks by then.

If you choose Top Notch Roofing, we will do all of the following on your behalf. We will give you a receipt for the total cost of the roofing job. If you have an RCV policy, we will send this receipt to the insurance company immediately. This receipt shows your insurance company the following:

Along with the receipt, request a reimbursement check for your “recoverable depreciation,” or replacement cost value. Recoverable depreciation correlates to the amount your insurance company discounted in the first actual cash value check for the depreciation for the life of the roof. Remember our example above for a roof with 20 year shingles that has aged 10 years.

It is your responsibility to request the depreciation check. If you do not request one, your insurance provider will not send one. Then, your insurance provider will issue another check for the balance of the job.

This two-step process is an effective method used by insurance companies to make sure the work they pay for is actually completed. It takes more time, but serves a valid purpose.

To summarize, if you have a RCV policy, then the only out of pocket expense you will ultimately have is your deductible. The insurance company reimburses you for the full amount of the roof job, except the deductible you agreed to when you set your policy.

If you have an ACV policy, then you will receive a percentage of the replacement cost (depending on how much your roof has aged) less your deductible. Under an ACV policy, you may be personally responsible to fund a large portion of the project.

We understand that this can be a very confusing process, especially if it is your first claim. Top Notch Roofing can help you during every step of the claims process. We take great pride in being professionals when dealing with your insurance company.

We are here to make sure your interests are not overlooked by your insurance company or an overworked, well-meaning adjuster. And, if we sign a contract with you (per your permission), we can speak with your insurance company so you do not have to.

Call Top Notch Roofing today at 321-299-3591 or contact us online to discuss your disaster recovery roof repair.

Read over your policy to make sure you have an RCV policy (one with recoverable depreciation.) Otherwise, you may be personally responsible to fund a large part of the project. A lot of insurance policies in Florida are changing to ACV policies on the roof coverage based on the age of the roof. However, the only out of pocket expense you should incur is the deductible you set.

Attempting to avoid paying your deductible by submitting inflated prices from a contractor or by keeping the insurance money without using it as designated is not only unethical, but can constitute insurance fraud, which is a felony. When everyone follows the proper procedures, the system works better for everyone. Make sure to set a reasonable deductible.

Disclaimer: Top Notch Roofing is not a licensed insurance agent, and this page is not meant to be insurance advice. We do not guarantee this information is correct. You should always consult with your insurance company for any questions.

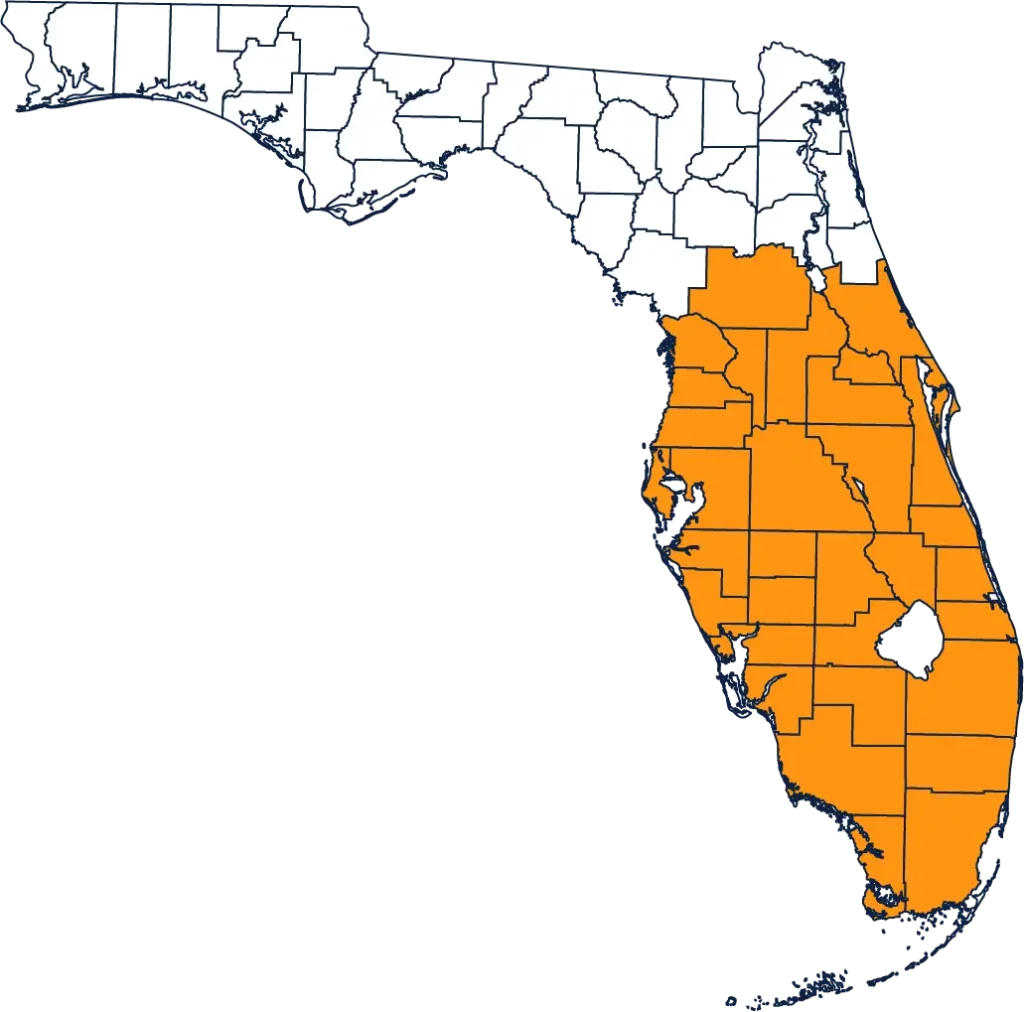

Having served Florida since 2008 and completing over 1000 reroofs, Top Notch Roofing has proven to be the best choice for any roofing needs one may have. We stay up to date with changes in roofing technology, application, and products, so we can offer the best roofing systems to our clients. It is our solid commitment to the industry and our customers that allows us to keep doing what we love and be one of the most trusted in the business. Take a look at the different counties we cover across Florida and then give us a call to schedule your free roof inspection.